What Should Be Used to Estimate Expected Returns

What is Expected Return?

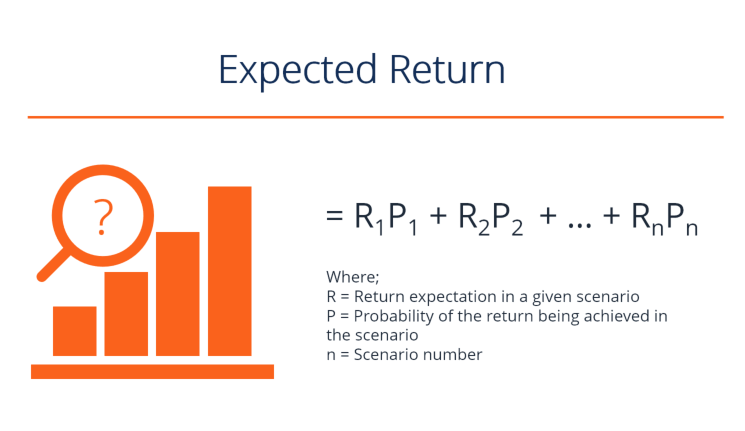

The expected render on an investment is the expected value of the probability distribution of possible returns it tin provide to investors. The return on the investment is an unknown variable that has different values associated with dissimilar probabilities. Expected return is calculated by multiplying potential outcomes (returns) by the chances of each event occurring, and so computing the sum of those results (as shown beneath).

In the short term, the return on an investment tin can be considered a random variable that tin take any values within a given range. The expected return is based on historical data, which may or may not provide reliable forecasting of time to come returns. Hence, the outcome is not guaranteed. Expected return is merely a measure of probabilities intended to show the likelihood that a given investment volition generate a positive return, and what the probable render will be.

The purpose of calculating the expected return on an investment is to provide an investor with an idea of probable profit vs risk. This gives the investor a basis for comparison with the run a risk-gratis rate of return. The interest rate on 3-month U.S. Treasury bills is often used to represent the risk-free charge per unit of return.

Nuts of Probability Distribution

For a given random variable, its probability distribution is a function that shows all the possible values it can take. It is bars to a certain range derived from the statistically possible maximum and minimum values. Distributions can exist of two types: discrete and continuous. Discrete distributions show but specific values inside a given range. A random variable post-obit a continuous distribution can take whatever value within the given range. Tossing a coin has two possible outcomes and is thus an instance of a detached distribution. A distribution of the height of developed males, which can take any possible value within a stated range, is a continuous probability distribution.

Download the Free Template

Enter your name and email in the form below and download the free template now!

Expected Return Template

Download the free Excel template now to advance your finance knowledge!

Calculating Expected Return for a Single Investment

Allow united states take an investment A, which has a 20% probability of giving a 15% render on investment, a fifty% probability of generating a 10% return, and a xxx% probability of resulting in a 5% loss. This is an example of calculating a discrete probability distribution for potential returns.

The probabilities of each potential return outcome are derived from studying historical data on previous returns of the investment asset being evaluated. The probabilities stated, in this case, might exist derived from studying the performance of the asset over the previous 10 years. Assume that it generated a 15% return on investment during two of those x years, a ten% return for five of the x years, and suffered a v% loss for three of the 10 years.

The expected return on investment A would then be calculated as follows:

Expected Return of A = 0.two(15%) + 0.v(ten%) + 0.3(-5%)

(That is, a 20%, or .2, probability times a fifteen%, or .xv, return; plus a l%, or .v, probability times a 10%, or .1, return; plus a 30%, or .three, probability of a return of negative five%, or -.five)

= three% + five% – 1.5%

= half dozen.5%

Therefore, the likely long-term average return for Investment A is 6.5%.

Calculating Expected Return of a Portfolio

Calculating expected return is not limited to calculations for a unmarried investment. It can also be calculated for a portfolio. The expected return for an investment portfolio is the weighted average of the expected return of each of its components. Components are weighted by the percentage of the portfolio's full value that each accounts for. Examining the weighted boilerplate of portfolio avails can also assistance investors assess the diversification of their investment portfolio.

To illustrate the expected return for an investment portfolio, let's presume the portfolio is comprised of investments in three avails – X, Y, and Z. $2,000 is invested in 10, $5,000 invested in Y, and $3,000 is invested in Z. Assume that the expected returns for 10, Y, and Z have been calculated and institute to be 15%, x%, and 20%, respectively. Based on the corresponding investments in each component asset, the portfolio's expected return can exist calculated as follows:

Expected Return of Portfolio = 0.2(15%) + 0.5(10%) + 0.3(twenty%)

= 3% + five% + 6%

= xiv%

Thus, the expected return of the portfolio is fourteen%.

Notation that although the simple average of the expected return of the portfolio's components is xv% (the average of 10%, 15%, and 20%), the portfolio's expected return of fourteen% is slightly below that elementary average figure. This is due to the fact that one-half of the investor's capital is invested in the asset with the lowest expected render.

Analyzing Investment Risk

In addition to computing expected return, investors also need to consider the risk characteristics of investment assets. This helps to make up one's mind whether the portfolio'southward components are properly aligned with the investor's risk tolerance and investment goals.

For instance, assume that ii portfolio components take shown the following returns, respectively, over the past five years:

Portfolio Component A: 12%, two%, 25%, -9%, x%

Portfolio Component B: 7%, 6%, 9%, 12%, vi%

Calculating the expected return for both portfolio components yields the same figure: an expected return of 8%. However, when each component is examined for risk, based on yr-to-yr deviations from the boilerplate expected returns, you find that Portfolio Component A carries five times more risk than Portfolio Component B (A has a standard deviation of 12.6%, while B'south standard deviation is only 2.half-dozen%). Standard divergence represents the level of variance that occurs from the average.

The Office of Hazard Tolerance and other Factors

The concept of expected render is role of the overall process of evaluating a potential investment. Although market analysts have come up up with straightforward mathematical formulas for computing expected render, private investors may consider additional factors when putting together an investment portfolio that matches upwards well with their personal investment goals and level of run a risk tolerance.

For example, an investor might consider the specific existing economic or investment climate conditions that are prevalent. During times of extreme uncertainty, investors are inclined to lean toward generally safer investments and those with lower volatility, even if the investor is commonly more risk-tolerant. Thus, an investor might shy away from stocks with high standard deviations from their average return, even if their calculations testify the investment to offer an first-class average return.

It's besides of import to go along in mind that expected return is calculated based on a stock'south past performance. However, if an investor has noesis near a company that leads them to believe that, going forward, information technology will essentially outperform as compared to its historical norms, they might choose to invest in a stock that doesn't appear all that promising based solely on expected render calculations. A helpful fiscal metric to consider in addition to expected return is the return on investment ratio (ROI) , a profitability ratio that straight compares the value of increased profits a company has generated through upper-case letter investment in its business.

Although not a guaranteed predictor of stock operation, the expected return formula has proven to be an excellent belittling tool that helps investors forecast probable investment returns and assess portfolio risk and diversification.

Related Reading

Thank you for reading CFI's guide on Expected Render. To continue learning and building your career as a financial annotator, these boosted resource will exist useful:

- Investing: A Beginner's Guide

- Capital Nugget Pricing Model

- Technical Analysis: A Beginner's Guide

- Footing Adventure

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/expected-return/

0 Response to "What Should Be Used to Estimate Expected Returns"

Publicar un comentario